Did you know that Severance Pay in Thailand is now capped at 400 days’ wages, making termination costs for long-term staff up to 30% higher than just a few years ago?

For business owners, HR leaders, and professionals navigating 2025’s updated regulations, missing a single detail could mean unexpected expenses or costly disputes.

Severance pay laws in Thailand are exact: eligibility hinges on contract type and length of service, while payment formulas and documentation requirements have never been more strictly enforced.

This guide breaks down the latest eligibility rules, calculation methods, exemptions, and compliance steps, so employers and employees alike can proceed with clarity and confidence.

Key Takeaways

- Severance pay in Thailand applies to employees with at least 120 days of service, except for serious misconduct or contract expiry.

- Payments range from 30-400 days’ wages based on service length and must be paid on the final working day.

- Special severance applies for relocation or automation; 15 days per year up to 360 days.

- Non-compliance can lead to fines up to THB 400,000 or jail; statutory severance is tax-exempt.

- Clear contracts and accurate records are key to compliance and dispute prevention.

Looking to outsource HR & payroll?

Our team handle payroll, HR administration, PEO employment, and full visa and relocation support.

Table of Contents

-

Severance Pay Eligibility in Thailand

-

Calculating Severance Pay in Thailand

-

Termination & Special Severance Rules

-

Severance Pay Procedures & Compliance

-

Employee Rights & Employer Strategies

-

FAQ: Severance Pay in Thailand

-

Conclusion

Severance Pay Eligibility in Thailand

Contract Types & Minimum Service Rules

Severance Pay in Thailand applies to employees with at least 120 days of continuous service under the Labor Protection Act.

Eligibility applies across these contract types:

- Permanent contracts: Full rights after 120 days.

- Fixed-term contracts: Eligible unless the contract only ends naturally.

- Probationary employees: Protected if they pass the 120-day threshold.

Ambiguous cases arise when contracts allow early termination or contain flexible probation clauses. In such instances, the Supreme Court often treats the relationship as permanent, making severance payment required.

Missteps often occur when employers mislabel permanent roles as fixed-term or fail to specify contract end dates clearly, risking unintended obligations.

Who Is Not Eligible for Severance Pay

Certain lawful exclusions remove eligibility for severance pay:

- Summary dismissal for serious misconduct

- Abandonment of duties for three consecutive workdays

- Contract expiration in legitimate project-based agreements

- Criminal conviction that results in final court imprisonment

Workers under contracts that expire as scheduled or who commit defined serious breaches are generally not entitled to payment, but employers must document these grounds precisely. Recent Supreme Court decisions show the risk of contract misclassification is growing, particularly for short-term or project-based roles.

For official updates, visit the Thailand Ministry of Labour.

If you understand service minimums, contract types, and exclusion rules, you can avoid the most common severance pay pitfalls in Thailand.

Calculating Severance Pay in Thailand

Official Severance Pay Tiers and Cap (2025 Update)

Severance pay in Thailand is calculated under clear statutory tiers, updated by the Labor Protection Act.

Use the following structure for employees with at least 120 days’ service:

- 120 days to <1 year: 30 days’ wages

- 1-3 years: 90 days’ wages

- 3-6 years: 180 days’ wages

- 6-10 years: 240 days’ wages

- 10-20 years: 300 days’ wages

- Over 20 years: 400 days’ wages (400-day cap since 2019 amendment)

“Wage” means the employee’s latest fixed or variable pay, and, for piece-rate staff, calculate based on the applicable earning period.

For a deeper understanding, read our Thailand minimum wage rates guide.

Calculation Examples & Special Cases

Picture this: A monthly-paid worker with 5.5 years’ service earning THB 30,000 per month is entitled to 180 days’ (or 6 months’) final salary, totaling THB 180,000.

For daily-wage employees: multiply the daily wage by eligible days per the above tiers.

Key points for unusual situations:

- Count partial years as full years only if the period exceeds half a year.

- Periods of unpaid leave are typically excluded from service calculations.

- Retroactive pay and misclassification are resolved by recalculating with the correct wage and tenure.

Employers and employees benefit from standardized formulas, helping ensure prompt and compliant payouts under Thai law.

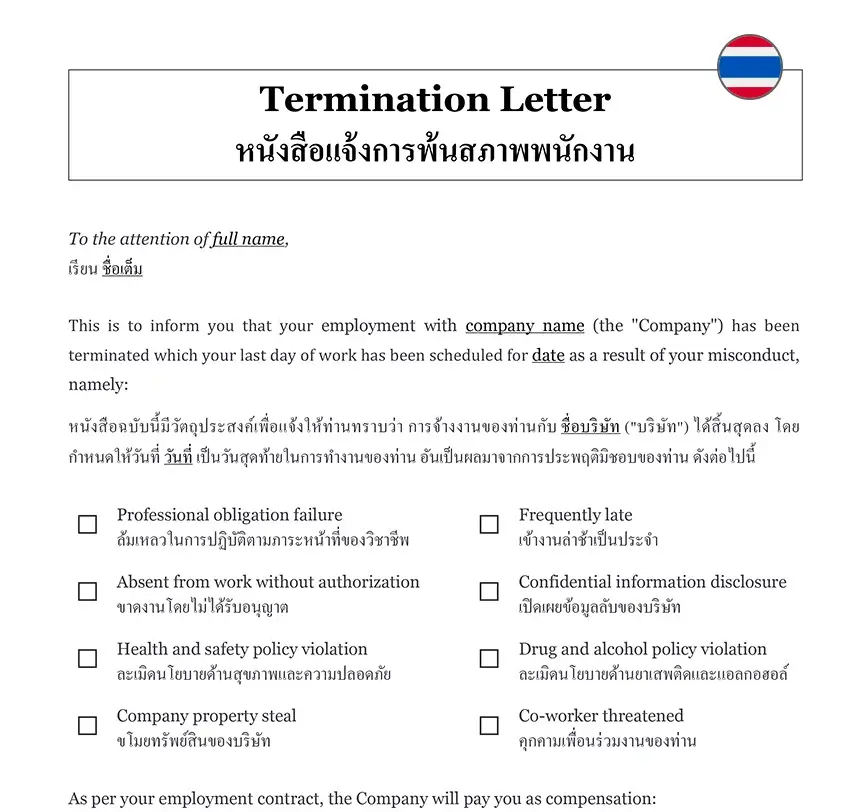

Termination & Special Severance Rules

Termination Scenarios & Exemptions

Employers in Thailand are not required to pay severance when termination is caused by specific employee actions.

Lawful exemptions include:

- Intentional damage to company property

- Dishonest performance or workplace crimes

- Negligence causing serious damage

- Repeat violation of written company rules

- Absence from work for three days without valid reason

- Court judgments imposing imprisonment

Fixed-term contracts expiring on agreed dates do not trigger severance pay, but contracts allowing early dismissal or vague probation periods may be classified as indefinite, potentially requiring payment. The Supreme Court has clarified that contracts with early termination clauses are often treated as permanent, increasing severance obligations.

| Ground for Termination | Severance Exempt? | Court Decisions/Notes |

|---|---|---|

| Serious misconduct | Yes | Must be documented, proven by the employer |

| Contract expiration | Yes | Only if fixed-term, performed until natural expiry |

| Early termination | Usually No | May lead to severance if terms are ambiguous or allow employer flexibility |

Severance for Relocation, Restructuring & Tech Changes

Thai law grants additional severance for employees affected by company relocation, restructuring, or automation initiatives.

Employers must:

- Give 30 days’ advance notice for relocations disturbing daily living

- Notify the Labour Inspector at least 60 days before large-scale layoffs owing to technology or restructuring

For employees with six years or more of service impacted by these changes, the special severance is:

- 15 days’ wages per year of service (up to a cap of 360 days’ wages)

- Paid in addition to standard severance

Failure to follow procedural requirements or notify workers in time can result in penalties, retrospective pay claims, and additional damages. Picture this: an automation rollout unaccompanied by timely notification exposes employers to legal action and higher compensation payouts.

Employers must balance business needs with precise compliance to avoid costly disputes. The right steps at termination are a smart investment in workforce stability and risk management.

For a deeper understanding of termination laws and procedures, read our termination of employment guide.

Severance Pay Procedures & Compliance

Process: Documents, Notice & Payment Timeline

Severance pay in Thailand follows a strict legal procedure in 2025. Employers must give written notice at least one pay period in advance or provide payment in lieu of notice.

Key requirements include:

- Written notice of termination, stating reasons and date

- Documentation of employment period, last wage, and calculation of all final entitlements

- Communication of details to both the employee and, if required, the Labour Inspector

Payment must cover:

- All earned salary up to termination

- Severance pay at statutory rates

- Payment for unused annual leave

- Payment in lieu of notice (if applicable)

Payments are required immediately on termination, ensuring all statutory entitlements are settled together.

Enforcement, Penalties and Taxation of Severance Pay

Non-compliance triggers enforcement by the Labour Court or Labour Inspector. Since 2019, penalties include fines up to THB 400,000 and possible imprisonment for late or unpaid severance.

Recent tax regulations (MR No. 394, July 2024) clarify that severance pay within statutory limits is tax-exempt. Any excess is now subject to income tax.

If an employer fails to pay within the required timeline, employees can initiate claims that may proceed quickly through the Labour Court’s “fast-track” channels.

See Thai Revenue Department for the latest severance taxation updates.

Employee Rights & Employer Strategies

Rights & Disputes: If Severance Is Denied or Underpaid

Employees in Thailand have clear legal channels to contest denied or underpaid severance pay.

If you believe your severance pay was miscalculated or withheld:

- Request a written explanation and detailed calculation from your employer

- File a formal complaint with the local Labour Protection Office

- Escalate unresolved cases to the Labour Court, which offers expedited resolution

Employers must maintain transparent records and follow Labour Protection Act procedures to minimize liability.

Workforce Planning, Contracts & Financial Impact

Accurate severance budgeting should be built into workforce planning, especially with the updated 400-day cap increasing costs by up to 30% for long-term staff.

Best practices include:

- Using written contracts that clarify fixed-term vs. indefinite status

- Regularly reviewing employment status to avoid costly misclassification

- Conducting annual severance liability audits for accurate financial forecasting

Strategic legal planning helps employers maintain compliance, while employees benefit from strong statutory protections. The best way to manage severance risk in Thailand is through proactive contract clarity and open, timely communication.

FAQ: Severance Pay in Thailand

Severance pay in Thailand is governed by clear statutory rules, but everyday scenarios raise important questions for employers and employees.

Employers must pay unused annual leave together with severance pay, ensuring that all accrued entitlements are settled at the time of termination.

Payment Timelines, Negotiation, and Coverage

Key points every business or professional should know:

- Severance, final salary, and accrued unused leave must be paid immediately upon termination or by the legally set deadline.

- Severance amounts can exceed legal minimums if agreed upon in contracts or collective agreements.

- Foreign employees are entitled to the same severance rights as Thai nationals when statutory criteria are met.

Example: If an employee with five years’ service is terminated, they must receive 180 days’ wages, all unused leave, and any notice pay together, usually on the last working day.

Conclusion

Taking a proactive, well-documented approach to severance pay is the key to confident compliance, protecting your business interests and ensuring fair treatment for every employee.

From contract clarity to timely payments, the decisions you make today will shape legal certainty and operational resilience tomorrow.

If you want to streamline severance processes, avoid costly compliance risks, or need guidance on contract audits, contact us. Themis Partner translates complex Thai regulations into practical solutions, so you can focus on growth with complete peace of mind.