Electric car company and EV industry in Thailand

Global and Regional Demand

According to the International Energy Agency (IEA), global sales of electric vehicles in 2019 are expected to be around 2.1 million units, representing a 40 percent increase over 2018. This indicates a growing demand for electric vehicles globally. Similarly, the global accumulated EV unit increased by 60% on average between 2014 and 2019.

Thailand’s EV stock has been steadily increasing in response to local demand. More importantly, several well-known Thai companies have been actively investing in EV charging infrastructure across the country, indicating a growing belief in future demand surge.

Supply-Side Factors and a Beneficial Ecosystem

Thailand, the 11th largest automotive producer in the world and the first in ASEAN, is poised to become ASEAN’s EV hub, thanks to its well-established value chain, which provides the industry with top-notch quality products at a competitive price.

Thailand has a strong and comprehensive automotive supply chain, with over 1,700 companies in the upstream supporting industry, 1,820 auto parts suppliers (720 in Tier 1 and 1,100 in Tier 2 and 3), and over 35 automobile and motorcycle brands. Efforts by public and private sector institutions to expand EV infrastructure, such as charging stations, indicate that Thailand’s EV ecosystem is developing rapidly.

Government and BOI Assistance

The Thai government, through the Board of Investment (BOI), provides extensive investment incentives for almost every segment of the electric vehicle market. It helps foreigners to set up an electric car company in Thailand. These include corporate income tax exemption for up to 8 years. Furthermore, key electric vehicle parts (e.g., BMS, Motor, and DCU) are eligible for additional years of CIT exemption in addition to assembly. As always, the BOI investor facilitation services strive to make the process as easy as possible for all incoming companies.

Set up an electric car company in Thailand

Secure your investment with the help of our corporate lawyers

An Overview of Thailand's Automotive Industry

Production Capacity Overview

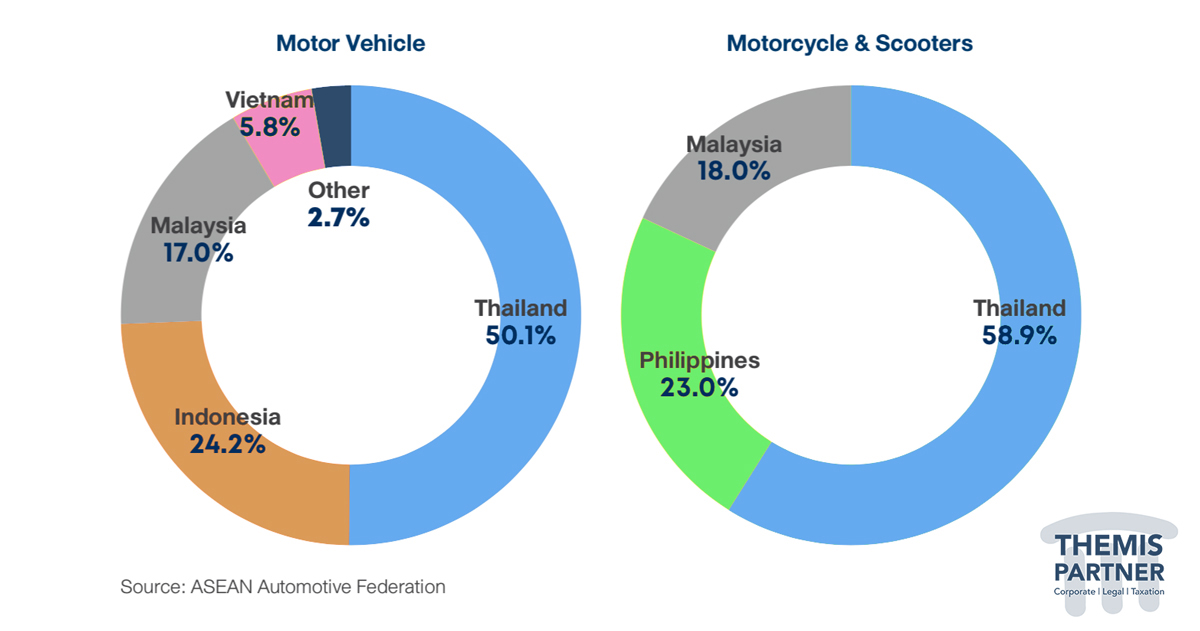

Thailand is the largest auto producer in ASEAN. In 2020, production will total 1,427,074 units, accounting for 50.1 percent of total ASEAN production. This is followed by Indonesia (690,150 units, or approximately 24.2%), and Malaysia (485,186 units, or approximately 17.0%). Thailand is also the leader in motorcycle and scooter production, with 1,615,319 units produced in 2020, accounting for 58.9% of ASEAN production. Philippines and Malaysia come in second and third, with 631,370 and 494,490 units, respectively.

Overview of the ASEAN electric car market

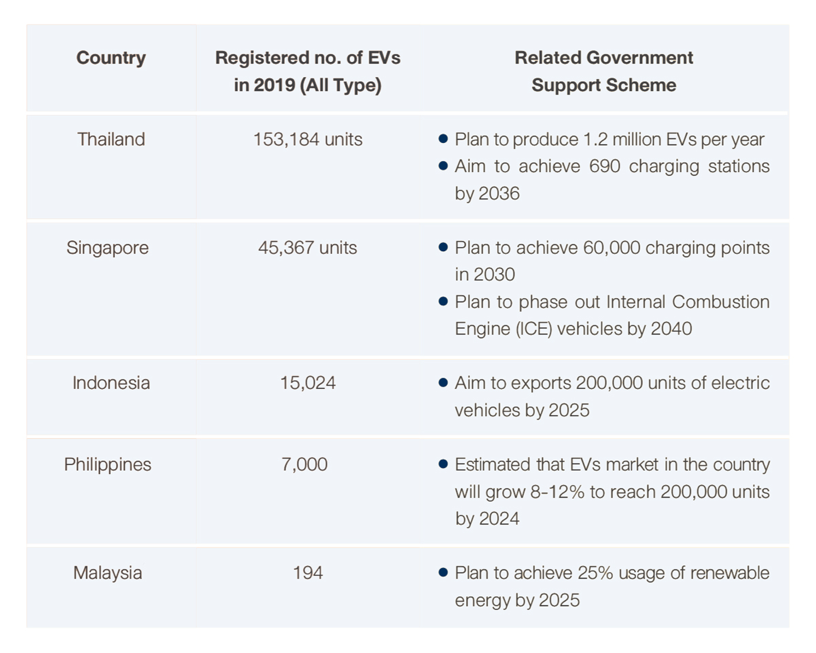

Thailand is not only the largest EV producer in Southeast Asia, but it is also the largest EV market in the region and therefore the most attractive market in asia to set up an electric car company. Thailand has 153,184 newly registered EVs in 2019, followed by Singapore, which has 45,367 units.

In-depth Knowledge of the Thai EV Market

In terms of production, Thailand will be the world’s 11th largest automotive producer in 2020, a position it has held since 2018. As of 2020, Thailand had a total accumulated number of 186,271 electric vehicles, with passenger cars (HEV/PHEV) accounting for 93 percent of all EV in Thailand.

Investment Possibilities

PHEV, BEV, AND HEV

Various public and private sector incentives and initiatives on electric vehicle passenger cars, as well as various supporting industries, make BEV, PHEV, and HEV a promising business opportunity. Indeed, here are some examples of incentives to set up an electric car company in Thailand:

The Electric Vehicle Association of Thailand is collaborating with the Thai government to implement a coordinated plan to increase the number of PHEV and BEV units to 1.2 million units by 20351, as well as 690 charging stations to support the electrical vehicle ecosystem.

Growing demand for ride-sharing in ASEAN, as evidenced by an increase in the number of users for both traditional taxis and transportation apps, “CABB EV” launched an EV taxi prototype, all made in Thailand, that will be ready for service in 2022, with a capacity of 1,200 cars per year and exports to overseas markets.

Motorcycle with Lithium-Ion Battery

On the other hand, Thailand’s government has established solid incentive packages for the battery electric motorcycle industry in tandem with Thai manufacturers’ competitiveness over neighboring countries.

According to World’s Top Exports, Thailand is the world’s fifth largest motorcycle exporter, with a total value of $ 1.8 billion (2019) and a total production capacity of 3 million units per year. Thailand has a well-developed motorcycle supply chain, ranging from supporting parts (tires, electronics parts) to production and assembly manufacturing capability.

Motorcycles are one of Thailand’s most important domestic manufacturing industries, with many manufacturing plants (localization) capable of meeting ASEAN demand.

Bus, truck, and tricycle powered by batteries

The potential rise of battery electric buses, trucks, and tricycles is another example of an electric vehicle business that has piqued the interest of numerous Thai private companies.

Energy Absolute Plc. (Alternative energy focused conglomerate) plans to be a supplier of electric buses for the state-run Bangkok Mass Transit Authority (BMTA) to replace current fleet of buses across Bangkok as part of Thailand’s government plan to promote electric vehicle industry with the goal of achieving goals of 50 percent of new car production or 1.25 million units by 2030.

Banpu Plc. (Energy conglomerate) is pursuing this possibility for battery electric tricycles, with intentions to raise the number of electric tricycles (Tuk-tuks) to 1,000 by the end of 2021 and 5,000 by 2025.

Aside from the potential possibilities for each type of car, there are some more reasons to be optimistic about Thailand’s electric vehicle business.

Investment Incentives That Pay Off

Electric vehicles are one of the main industries that the Thai government wants to promote by granting massive investment incentives through BOI channels, including at least three years of corporate income tax exemption for the producer for practically every type of vehicle. The aim is to encourage foreigners to set up an electric car company in Thailand.

Furthermore, as previously stated, massive investment incentives policies are in place, including an up to 8-year corporation income tax exemption for Battery Electric Vehicles (BEV).

Private Funding for Electric car Research and Development

ℹ️ Many Thai commercial enterprises are partnering with government organizations or research institutions to undertake EV research and development initiatives, which is helping to advance and accelerate EV technology.

PTT Plc (Energy conglomerate) is pursuing research and development in the areas of automotive, charging station, hydrogen, and battery technology. Alternatively, Nissan’s automotive manufacturing firm has donated five first-generation Nissan LEAF (a cutting-edge technological vehicle that runs entirely on electricity) to Thai institutions. To give academic automotive professionals with a first-hand grasp of electric vehicle engineering and technology.

Regional demand for electric cars is growing

Nissan, a well-known car manufacturer, sees potential in ASEAN’s demand for electric vehicles. According to a Frost & Sullivan Co. survey of 3,000 people in six ASEAN countries (Philippines, Thailand, Indonesia, Malaysia, Vietnam, and Singapore), 66 percent of people in these countries believe that electric vehicles will dominate vehicle markets in the near future.

EV Charging Infrastructure Expansion

ℹ️ Thailand has 664 electric vehicle charging stations as of April 2021, with a steady increase in the number of stations.

The expansion of EV infrastructure is an important trend that runs parallel to the Thai government’s EV roadmap. Incorporate with a large number of private companies that are eager to invest in this venture.

For example, Energy Absolute Plc wants to grow its number of electric vehicle charging stations from 400 to 1,000 across the country. To meet future demand, Thai enterprises such as PTT Oil and Retail, the Electric Generating Authority of Thailand (EGAT), the Metropolitan Electricity Authority, and the Provincial Electricity Authority are operating.

Development and the Private Sector

Many local and worldwide collaboration projects involve Thai research and development organizations and the corporate sector.

PTT Plc (an energy conglomerate) works on car, charging station, hydrogen, and battery technology.

Furthermore, in 2021, PTT Oil and Retail (PTTOR) (a subsidiary of PTT Plc.) will collaborate with EVLOMO to implement a charging network project across Thailand (with 2,290 fuel stations currently) and will install over 1,000 new fast chargers (every 50 kilometers) to accelerate EV adoption in Thailand (with 2,290 fuel stations currently).

Nissan has invested billions of Thai Baht in the electric car industry, as part of a strategic effort to make Thailand the global EV export hub.

Support from the government

Focus area

Thailand’s government provides funding for the EV sector through the BOI channel. However, there are particular areas of focus in the electrical vehicle manufacturing industry that provide additional incentives.

| ➤ Battery Electric Motorcycle |

| ➤ Battery Electric Tricycle |

| ➤ Electric Vehicles (BEV, PHEV, and HEV) |

| ➤ Buses and trucks powered by batteries |

| ➤ EV Charging Station |

| ➤ EV Key Parts |