Ready to use legal template

Work on without any hassle

Certified Thai-English translation

Ready to use legal template

Work on without any hassle

Translated in Thai-English

Home › Accounting services › Invoice

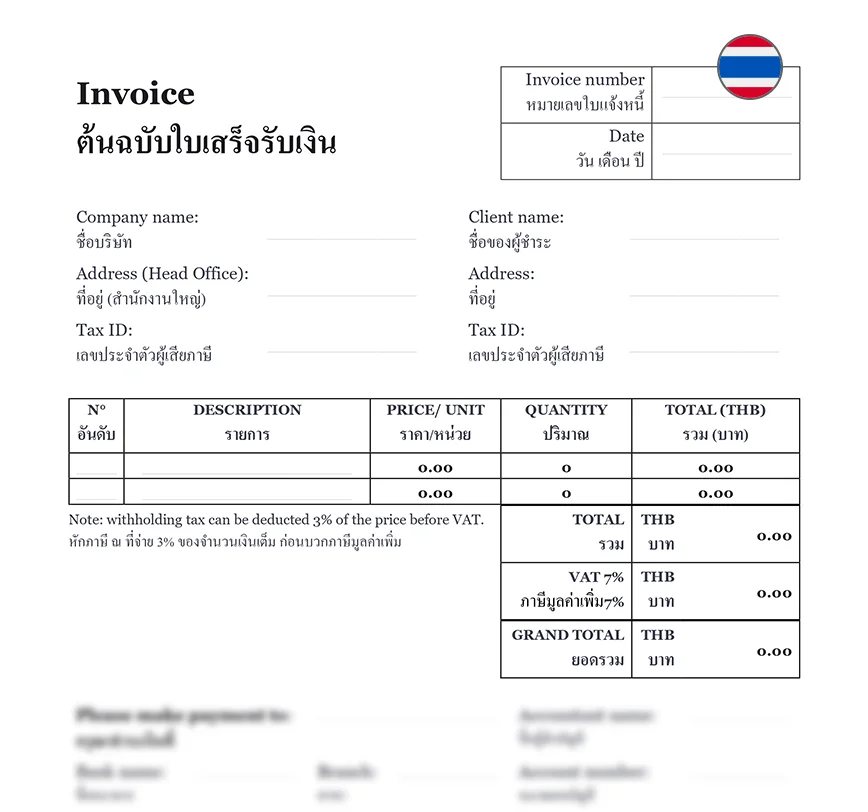

Learn more about Invoice

An invoice is a formal document issued by a seller to a buyer, detailing the products or services provided, their costs, and the payment terms. It serves as a crucial financial record, ensuring transparency in business transactions and enabling proper bookkeeping. In Thailand, invoices play a key role in tax compliance, as they support VAT reporting and corporate accounting requirements under the Thai Revenue Department. Businesses must issue invoices correctly to avoid legal complications and ensure smooth financial operations. Whether you run a small business or a large corporation, having a well-structured invoice is essential for managing payments efficiently. Download our Invoice Form, professionally drafted in English and Thai, fully editable in Word format, and compliant with Thai business practices.

Table of contents

What should be mentioned in an invoice?

To be valid, the legal information listed by the tax department must be mentioned. In order to avoid having to re-edit all of these elements for each new invoice created, it is advantageous to use pre-established invoice templates, such as the compliant and easy to edit invoice template we offer.

The document must mention the term “invoice” and a unique number: this is usually an aggregation of the name of the month, the year and an amount corresponding to the invoice.

But several other elements must be mentioned in an invoice, such as payment dates and deadlines, product descriptions and prices, customer contact information, and the supplier’s company.

Can I send an electronic invoice to my client?

The Thai Ministry of Revenue recently issued a ministerial regulation allowing registered VAT filers to collect and send electronic tax invoices and receipts to their customers for the full or partial sale of goods or provision of services. It will no longer be necessary to print these documents and submit them in paper form.

The process for issuing electronic invoices and receipts includes the following steps:

The VAT filer submits an application for approval by the Executive Director of the Department of Revenue. The applicant meets specific eligibility criteria: The customer’s tax identification number and specify the registration number of the branch or headquarters. When authorized by the Director General of the Revenue Department, the applicant must comply with the rules and conditions for the preparation and retention of electronic tax invoices and receipts prescribed in these regulations.

When signing electronically, ensure that the electronic tax invoices and receipts contain two digital signatures created by the means prescribed in these regulations, and a certificate and signature certificate number issued by a certification authority approved by the Revenue Department. Data on electronic tax bills, credit and debit slips and receipts must be transferred to the Thai Revenue Department every month.

This is a big step forward and is part of the Revenue Department’s policy to make taxation more efficient for businesses in Thailand. It is expected to become better known over time as the Revenue Department encourages businesses to follow its program.

How to invoice if your company is registered for VAT?

The tax rate is an important consideration when invoicing your customers as a VAT registered business in Thailand. The point of taxation is the day when VAT is due, and this day varies depending on whether you are selling goods or services. VAT is due on the sale of goods when they are delivered, regardless of the date of payment. In addition, if prepayment is made before delivery, VAT is due upon receipt of payment. VAT is due when the customer pays for the provision of services, regardless of the nature of the service.

1. Regarding the sales of goods in Thailand

VAT is due when your goods are delivered, so you must give a Tax Invoice to your customer. The actual wording could be Invoice/Tax, Invoice/Delivery or similar, as the Tax Invoice is included. You then issue a receipt when your customer pays you for the product.

2. Regarding the services

After providing services, you are supposed to issue an invoice to your customer, but not a tax invoice because VAT is not yet due. VAT is now due when the customer pays you, and you must then issue a tax invoice/receipt.

What are the regulations regarding tax invoices?

Subject to Sections 86-1, 86-2 and 86-8 of the Revenue Code, a VAT taxable person shall immediately issue tax invoices and copies thereof for each sale of goods or services at the time the tax liability arises, and send such tax invoices to the purchaser of goods and services, and retain a copy thereof in accordance with Section 87/3.

Contractors exempt from VAT registration but temporarily registered for VAT pursuant to Section 85-3 may issue tax invoices if they comply with the law, procedure and conditions of the Director General.

The issuance of a tax invoice shall be through the place of business, unless otherwise directed by the General Manager.

The issuance of tax invoices by an agent on behalf of the taxable person shall be in accordance with the law, policy and conditions of the General Manager.

SPECIAL OFFER

Accounting

15 Document Package

Essential forms and guides for managing your finances in Thailand

Share information

Why Themis Partner?

Easy legal documents at your fingertips

Make trusted documents for hundreds of purposes.

Hundreds of documents

Instant access to our entire library of documents for Thailand.

24/7 legal support

Quick legal advice from our network of qualified lawyers.

Easily customized

Editable Word documents, unlimited revisions and copies.

No translation fees

Certified Thai-English translation included for all documents.

Legal and Reliable

Documents written by lawyers that you can use with confidence.

Free consultation

Free lawyer consultation on each new matter.