Ready to fill official form

Includes VAT Guide

Last update in 2024

Ready to fill official form

Includes VAT Guide

Last update in 2024

Home › Accounting services › Value added tax (VAT)

Learn more about Value Added Tax (VAT)

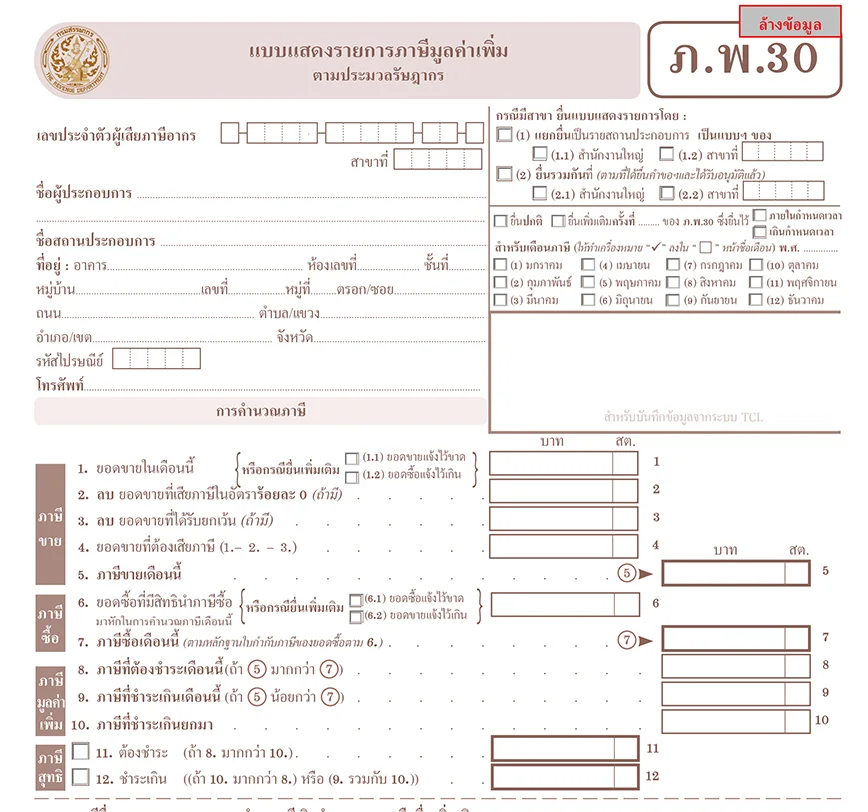

In accounting, VAT must also be taken into consideration. Indeed, any person or entity supplying goods or services must register for VAT if their annual turnover exceeds 1.8 million baht. The registration takes place within 30 days after the threshold is exceeded with the tax authorities via the form PP 01. As soon as the company is registered for VAT, it is obliged to make two monthly declarations. Firstly, it must declare the different amounts of VAT collected and disbursed during the month in order to calculate the VAT payable. The declaration is made by means of the form PP 30. The taxpayer must also pay VAT on behalf of its foreign service providers who are not registered in the Thai system. In this case, as soon as the Thai company uses a service from foreign suppliers, it must submit a 7% VAT return on their behalf via form PP 36.

Table of contents

-

Who should pay the value added tax?

-

Which activities are exempt from VAT?

-

How to register for VAT?

-

How is VAT calculated?

-

What is the current VAT tax rate?

-

How to pay VAT?

-

When can VAT be refunded?

-

What are the penalties for late payment?

-

Do I have to pay when exporting goods out of Thailand?

-

Do I have to pay when importing goods into Thailand?

-

Is there a specific tax on certain goods?

Who should pay the Value Added Tax?

Any company established of goods or services in Thailand with annual turnover exceeding 1.8 million Baht is subject to value added tax in Thailand. Tax registration is mandatory within 30 days from the date the turnover exceeds 1.8 million Baht.

Which activities are exempt from VAT?

Certain activities are exempt from Value Added Tax. Below is the non-exhaustive list of goods and services exempt from payment of Value Added Tax:

- Unprocessed agricultural products such as fertilizers, animal feed or pesticides, etc.

- Newspapers, magazines and textbooks

- National and international transport by land

- Health services by public and private hospitals

- Education services provided by public and private schools

- Medical and auditing services, lawyers in court

- Cultural services such as amateur sports, libraries, museums, zoos

- Other services such as religious and charitable services, administration and local authority services

How to register for VAT?

Value Added Tax registration is compulsory for any person or entity liable for Value Added Tax in Thailand via a form entitled VAT PP 01 either before the start of the operation of the company or within 30 days of the reaching the income threshold. The application for registration must be submitted to the Area Revenue Offices if the company is located in Bangkok or to the Area Revenue Branch Offices if the company is located elsewhere. In case the taxpayer has more than one branch, the registration application should be submitted to the Revenue Office instead of the registered office of the company.

The documents to be communicated to register the company for VAT are as follows:

| ➤ Two copies of the housing registers and the identity card of the owner of the building with signature in the event of rental of the premises |

| ➤ Two copies of the housing registers where the company is located with the signature of the owner of the building |

| ➤ Two copies of the housing registers and the identity card of the director of the company with signature |

| ➤ Photograph of the company headquarters |

| ➤ Two copies of the business plan with signature |

| ➤ Two copies of the rental agreement in case of rental of premises |