Ready to use legal template

Drafted by experienced lawyers

Certified Thai-English translation

Ready to use legal template

Drafted by lawyers

Translated in Thai-English

Home › Business contracts › Freelance Contract

Learn more about Freelance Contract

A Freelance Contract in Thailand is a crucial legal document that governs the working relationship between freelancers and their clients, providing clarity on terms, responsibilities, and payment agreements. Whether you’re a freelancer offering your services or a client seeking to hire freelance talent, having a well-structured contract is essential to ensure a smooth and legally compliant partnership. At Themis Partner, we understand the significance of a Freelance Contract tailored to the Thai market. That’s why we offer an easily editable legal template, meticulously drafted by our experienced lawyers to align with Thai laws and regulations. This versatile template allows you to customize your Freelance Contract, ensuring it accurately reflects the specifics of your freelance work arrangement while providing legal protection and clarity.

Table of contents

-

What is a Freelance Contract in Thailand?

-

What does a Freelance Contract include?

-

What are the payment terms typically included?

-

Are Freelance Contracts legally binding in Thailand?

-

How do taxes and regulations impact freelance work?

-

Can this template be used for different types of freelance services?

What is a Freelance Contract in Thailand?

A Freelance Contract in Thailand is a legally binding agreement between a freelancer (an individual or independent professional) and a client or hiring party. This contract outlines the terms and conditions of the freelance work arrangement, defining the scope of work, project details, payment terms, deadlines, intellectual property rights, confidentiality clauses, and other essential provisions. It serves as a formal agreement that establishes the rights, responsibilities, and expectations of both parties, ensuring clarity and legal protection throughout the freelance engagement. Freelance Contracts in Thailand are crucial for establishing a clear working relationship, preventing disputes, and ensuring that both freelancers and clients are aware of their obligations and rights under the law.

What does a Freelance Contract include?

A comprehensive Freelance Contract in Thailand typically includes the following key components and clauses:

1. Identification of Parties

The contract begins by identifying the parties involved, namely the freelancer (the individual providing freelance services) and the client or hiring party, including their legal names, addresses, and contact information.

2. Scope of Work

This section details the specific freelance services or projects to be completed, including a clear description of the tasks, deliverables, and deadlines. It outlines the expectations of both parties regarding the work to be performed.

3. Payment Terms

The contract specifies the payment details, including the freelance fee or compensation structure, payment schedule, and any additional expenses or reimbursements. It may also include information about invoicing and payment methods.

4. Intellectual Property Rights

Clauses addressing the ownership of intellectual property (IP) rights, including copyrights, trademarks, and other proprietary rights, are outlined. It clarifies whether the freelancer retains ownership of their work or transfers IP rights to the client.

5. Confidentiality

Confidentiality clauses establish the obligation to maintain the confidentiality of sensitive information shared during the freelance project. It safeguards trade secrets and proprietary data.

6. Revisions and Changes

Procedures for handling revisions, modifications, or changes to the project scope are detailed, including any associated fees or timelines.

7. Termination

The contract outlines the conditions under which either party can terminate the agreement, including notice periods and reasons for termination.

8. Dispute Resolution

Procedures for resolving disputes that may arise during the freelance engagement, such as negotiation, mediation, or arbitration, are specified.

9. Indemnification

Clauses addressing liability and responsibility for damages, errors, or breaches of contract are included.

10. Governing Law

The governing law of the contract is identified, typically Thai law. Force Majeure: Provisions for handling unforeseen events or force majeure situations that may disrupt the freelance project are included.

What are the differences with an Employment Contract?

Freelance Contracts and Employment Contracts in Thailand represent contrasting work relationships. Freelance Contracts apply to independent contractors who offer services on a project basis, granting autonomy but lacking employee benefits and protections. In contrast, Employment Contracts define traditional employee-employer relationships, entailing ongoing work, benefits, and labor protections. Freelancers handle their own taxes, while employees have taxes withheld by employers. Legal rights and control vary, with freelancers being self-employed and employees enjoying extensive labor protections. The choice between the two hinges on the nature of the work and the desired work relationship structure.

What are the payment terms typically included?

In Thailand, payment terms in Freelance Contracts encompass various aspects, including specifying the payment amount, the schedule for payments (e.g., upfront, milestones, or upon project completion), invoicing details, preferred payment methods, provisions for late payments, currency used, expense reimbursements, tax responsibilities, payment confirmation procedures, possible retention of funds, currency conversion, and terms for payment in case of contract termination.

ℹ️ These terms aim to establish clear and equitable payment arrangements between freelancers and clients, ensuring transparency and minimizing payment-related disputes during project execution.

Are Freelance Contracts legally binding in Thailand?

Freelance Contracts in Thailand are legally binding agreements that establish the terms and conditions of freelance work arrangements. When properly drafted, agreed upon, and signed by both parties, these contracts become legally enforceable, obligating the freelancer and the client to fulfill their respective contractual obligations. To ensure legal compliance and validity, it is advisable to draft clear and precise contracts, seek legal consultation when necessary, and maintain thorough documentation of the agreement. This ensures that Freelance Contracts provide a robust legal framework for freelance work relationships while adhering to Thai laws and regulations.

How do taxes and regulations impact freelance work?

Taxes and regulations have a significant impact on freelance work in Thailand. Freelancers are generally responsible for income tax reporting and potentially VAT obligations. Clients may need to withhold taxes on payments, depending on the nature of services. Proper business registration, work visas for foreign nationals, and compliance with labor laws are crucial. Freelancers should ensure their contracts align with Thai laws and regulations and consider insurance for protection. Staying informed and seeking professional guidance on tax and legal matters is essential to navigate the regulatory landscape effectively and maintain compliance while conducting freelance work in Thailand.

Can this template be used for different types of freelance services?

Yes, this Freelance Contract templates are designed to be versatile and adaptable to various freelance service categories, such as writing, design, consulting, programming, and more. They typically include generic clauses that can be customized to fit specific projects and services. However, the extent of customization and specific clauses required may vary depending on the nature of the services.

SPECIAL OFFER

STARTUP

15 Document Package

Essential documents for running your business in Thailand

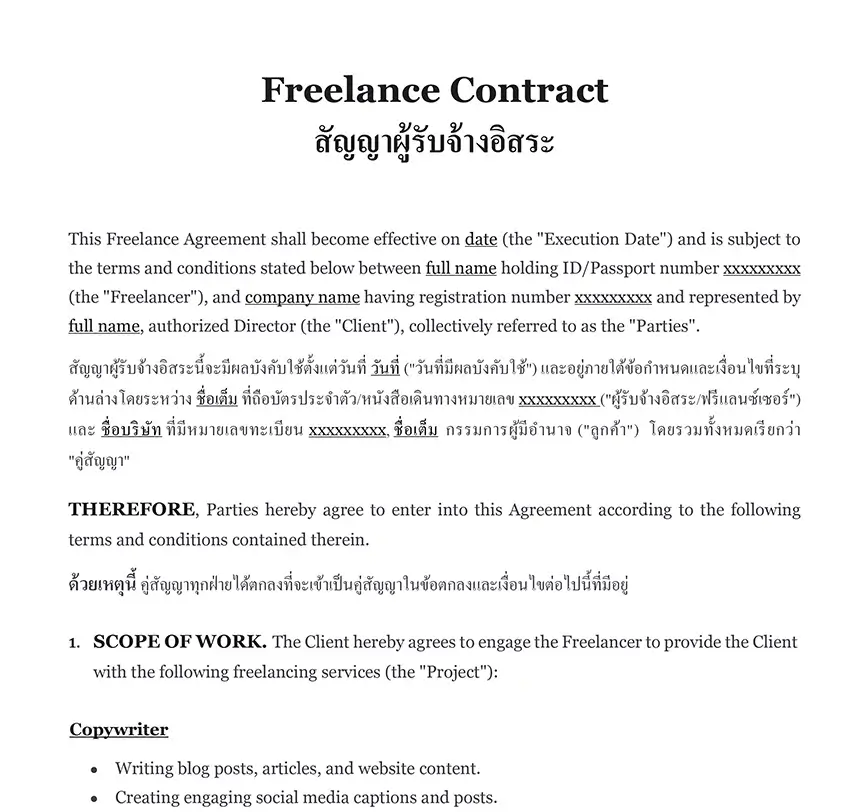

Freelance ContractTemplate (.docx)

Save on attorney fees

310 client reviews (4.8/5) ⭐⭐⭐⭐⭐

Share information

Why Themis Partner?

Easy legal documents at your fingertips

Make trusted documents for hundreds of purposes.

Hundreds of documents

Instant access to our entire library of documents for Thailand.

24/7 legal support

Quick legal advice from our network of qualified lawyers.

Easily customized

Editable Word documents, unlimited revisions and copies.

No translation fees

Certified Thai-English translation included for all documents.

Legal and Reliable

Documents written by lawyers that you can use with confidence.

Free consultation

Free lawyer consultation on each new matter.