Thailand: 11th largest asian exporter for clothing business

Thailand attracts many years of foreign investors to register a company in the textile field. The Thai government offers tax and non-tax benefits to BOI companies. Themis Partner also helps you with your accounting and tax to obtain the required FBL licenses and to get foreign business ownership. But why is Thailand so attractive for clothing business?

Every year, huge amounts of high-quality Thai fabrics and apparel are sold domestically and exported to the rest of the world. In 2016, the textile industry’s export revenue was nearly USD 7 billion, accounting for more than 3% of total exports, with key customers including ASEAN, the United States, Europe, and Japan.

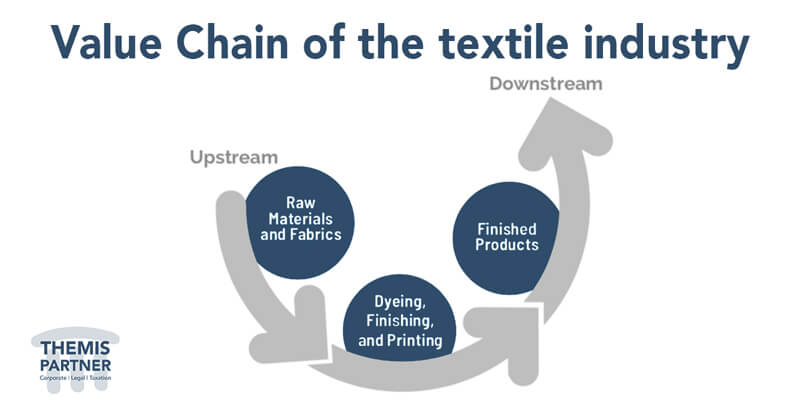

Thailand is one of the few countries in the world that offers the entire textile value chain, from upstream to downstream. With over 4,700 local textile producers, Thailand supports a wide range of activities along the entire textile value chain, from fiber and fabric production to the design, manufacturing, and sale of apparel and functional textiles.

Clothing Business: Raw Materials and Fabrics

1. Fibers

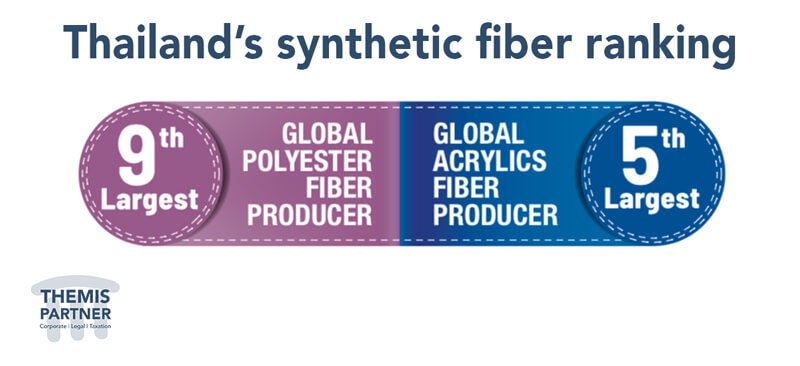

Thailand is a leading global producer of synthetic fibers, ranking ninth in the world in polyester production and fifth in acrylics production. Every year, the country produces approximately 900,000 tons of synthetic fibers. Domestic production and consumption of man-made fibers increased by 6.4 percent and 12.3 percent year on year in 2016, respectively.

Thailand is home to major producers of synthetic fibers in the region, including many joint ventures and subsidiaries of multinational companies such as Indorama Polyester, Teijin Polyester, and Thai Toray, thanks to its strong petrochemical industry foundation and cutting-edge technology.

2. Yarns

Thailand’s textile industry is constantly developing and evolving, so it has increased its production efficiency to produce high-quality yarns. Each year, Thai clothing business and manufacturers spin more than 800,000 tons of cotton and man-made yarns, with 70% of the output consumed domestically. In 2016, yarn exports alone were worth over USD 700 million. Major clothing business export destinations include Indonesia, Taiwan, China and Japan.

3. Fabrics

Thailand is known for its ability to weave and knit world-renowned fabrics of superior quality, thanks to an abundance of high-quality raw materials. Thailand exported over USD 1.2 billion in fabrics in 2016, primarily to ASEAN countries.

Thailand has become a leading producer of fabrics in the region thanks to decades of heavy investment in R&D. The Thai Textile Institute recently developed the “smart fabrics quality mark” to help producers increase their competitiveness by ensuring textile and clothing product quality and standards.

1. Silk

Thailand is the seventh largest Asian exporter, with nearly USD 4.6 million in export value each year. Silk has a long history of positively shaping the Thai textile industry’s heritage. The original hand-woven process showcases the beauty of silk, which is unique across Thailand’s different regions, and represents a truly authentic Thai fabric.

2. Spandex

Spandex is a fabric made from elastomeric synthetic fibers that provides significant flexibility to many clothing business as underwear and sportswear brands. From 2016 to 2023, the global spandex market is expected to grow at a CAGR of more than 8%, with Asia-Pacific recording for more than 60% of global production. With a number of Thai manufacturers, spandex provides a solid foundation for Thailand’s rapidly growing sportswear industry.

Set up your company in the textile industry

Receive BOI incentive as corporate income tax exemption up to 8 years and Exemption of import duty on machinery and raw or essential materials used in manufacturing export products.

Dyeing, Finishing, and Printing

Thailand currently has over 400 factories engaged in the dyeing, finishing, and printing of yarns and fabrics for local clothing business and industry. New and innovative technologies, such as 3D and digital printing, are being used to boost the value of fabrics even further. A growing number of Thai factories, including Luckytex (Thailand) PLC and Erawan Textile Co., Ltd., are automating their production lines.

Finished clothing business products

In addition to textiles, Thailand’s finished clothing business sector, which includes both apparel and non-apparel items, is booming. The apparel retail market has been rising at a rate of 3.5 percent per year, which is three times the global rate.

1. Designer and fashion clothing business

Thailand’s fashion sector is developing very well, thanks to its excellent designs and advanced manufacturing techniques and standards. Bangkok has been designated as the Global Fashion Capital. The country has hosted numerous well-regarded regional and international fashion events, including Bangkok International Fashion Week, Elle Bangkok Fashion Week, and the Bangkok International Fashion Fair, for over ten years, thanks to strong government support.

Beyond typical cut-make-and-trim OEM production, Thailand is home to a slew of Thai designer labels, including NaRaYa, AIIZ, Jaspal, CPS Chaps, Sretsis, Disaya, and Doi Tung, all of which have made significant strides in raising their global brand awareness, as well as Dry Clean Only, which is well-known among Hollywood celebrities.

2. Clothing Apparel

Over 80% of raw materials, such as fabrics and yarns, may be sourced locally in Thailand, which has over 2,100 clothing business apparel producers. The country is noted for its highly skilled and competitive workforce, as well as the high quality of its products. Nike, Adidas, and GAP are just a few of the well-known worldwide brands that outsource production to Thailand.

High-Tech Apparel Co., Ltd., ICC Co., Ltd., Hong Seng Knitting Co., Ltd., Nan Yang Textile Co., Ltd., and Sahapat Co., Ltd. continue to dominate the Thai market and export high-quality clothing apparel to the rest of the globe. The United States, the European Union, Japan, China, and Vietnam are among the top export destinations.

1. Womenswear and Menswear

In 2016, the Thai womenswear and menswear clothing business markets both grew by 4% and 3%, respectively. By 2021, the womenswear and menswear markets are predicted to reach USD 3.5 billion and USD 2.6 billion, respectively. Despite the fact that the Thai womenswear market is slightly larger than the menswear market, male buyers tend to be more devoted to their preferred brands. Uniqlo, H&M, Zara, and G2000 are just a few of the global brands that are doing exceptionally well in Thailand.

2. Jeans

By 2022, Thailand’s jeans market is anticipated to be worth USD 426.7 million. Jeans will continue to be a popular leisurewear item among customers around the world for a long time. In addition to international brands such as Levi’s and Diesel, Mc Jeans is a prominent Thai brand that has gained in popularity throughout the region.

3. Underwear

Thailand’s underwear industry generated USD 1.7 billion in sales in 2016, up 6.5 percent from 2011. In terms of sales, women’s underwear retained the highest value among all womenswear categories. Many international underwear brands, including Wacoal, Triumph, J.Press, and Arrow, manufacture their products in Thailand. Thailand’s underwear is known for its high quality and durability across the value chain, as well as the superiority of synthetic yarns supplied by local companies.

4. Sportswear

Sportswear is growing at a double-digit rate, with a market value of USD 1.3 billion, thanks to the growing interest in health and fitness. While males are the primary buyers of sportswear, as more women lead active lifestyles and spend more time exercising on a daily basis, women are becoming increasingly interested in this category. Due to the growing health and wellness trends in Thailand, consumers want to wear sportswear for both fashion and function. High-Tech Apparel Co., Ltd., Tuntex Textile (Thailand) Co., Ltd., Thai Asahi Kasei Spandex Co., Ltd., Nice Apparel Co., Ltd., and Sahapat Co., Ltd. are among the companies that are supporting the rising clothing sports market‘s production needs.

Set up a clothing business to start selling apparel and clothing accessories in Thailand

310 client reviews (4.8/5) ⭐⭐⭐⭐⭐

3. Non-Apparel

1. Home textiles

Thailand’s home textiles are exported all over the world, including bedding, curtains, bathroom linens, and carpets. The intricate designs and hand-woven procedures that distinguish Thai home textiles from those from other nations ensure that items acquire a premium quality that is widely recognized around the world. Thailand exported about 121,000 tons of home textiles worth over USD 260 million in 2016.

In addition to their appealing designs, companies such as PASAYA and TAI PING have incorporated cutting-edge technology into their vast range of products, such as flame retardant and anti-allergic textiles, to meet changing customer requirements.

2. Established Wholesale Textiles Markets

Thailand is home to one of the largest garment marketplaces and world-renowned fashion districts in the region, in addition to extensive textile and clothing business manufacturing.

Bobae Market arose from the influx of Chinese immigrants in the early 1900s to provide a means of livelihood for the newly arrived migrants. Bobae has grown to become one of Asia’s largest textile market places, with over 3,000 shops. It is well-known for producing high-quality products at reasonable prices. Thai designers use the market as a major fabric sourcing location. Many foreign customers from Cambodia, Laos, Vietnam, Malaysia, and Singapore order fabrics directly from Bobae, resulting in a yearly trade value of more than USD 900 million. Sampeng and Pahurat are two more wholesale textile markets, while Chatuchak weekend market, Platinum Mall, and Pratunam in Bangkok are popular wholesale clothing markets among both locals and tourists.

Opportunities in textile industry

Thailand is increasing its competitiveness by emphasizing innovation, value-added products, and technologies. The government is providing additional incentives, as well as infrastructure development, to help the country’s textile industry grow.

1. Technical textiles

In 2020, the global technical textile market surpassed USD 160 billion. To meet the demands of this expanding market, Thailand’s textile industry has expanded in both variety and functionality, offering fabrics with functions that extend far beyond clothing business and home furnishings. Thai manufacturers are offering products with unique and cutting-edge properties, such as flame retardant, temperature regulated, and antimicrobial fabrics, thanks to groundbreaking technologies and advanced capacities.

1. Mobiltex

Automotive textiles are the world’s most valuable market for functional textiles. These materials have numerous applications. Fabrics reached more than 35 kilograms of an automobile’s total weight in 2020, up from 26 kilograms in 2010. Apart from being used to strengthen tires, hoses, safety belts, and air bags, more than half of automotive textiles are used for interior trim such as carpets, seat covers, doors, and roof liners.

Thailand currently has over 100 automotive textile manufacturers. Thailand is home to a number of major Japanese automotive textile manufacturers. Thailand, the largest automotive producer in Southeast Asia, produced more than 1.9 million vehicles in 2016, making the country an ideal location for global automotive textile production.

2. Protective textiles

Protective textiles, which range from particulate protection to flame retardant to cut resistant, are intended to shield the wearer from harmful environmental effects that could result in injury or death. Thailand’s demand for protective textiles continues to rise year after year, and reached USD 8.4 billion in 2018. One of the most common protective uniforms is the flame-resistant suit. Many leading protective textile manufacturers, such as Insuretex and Glofab, are based in Thailand and serve both domestic and international markets.

3. Medtex

The combined market for medical devices in the ASEAN Economic Community (AEC) in 2016 was around USD 2.8 billion. Thailand had the largest market share at 28 percent, followed by Malaysia, Indonesia, and Vietnam as an international medical hub. Because of the high local demand for healthcare and hygiene products, the country required more than 700,000 medical uniforms in 2019, excluding surgical and patient clothing business. With approximately 59 manufacturers in 2016, the value of Thailand’s medical textiles reached USD 600 million, with a 3.4 percent average annual growth rate.

4. Agrotex

Thailand is fortunate to be one of the top agricultural locations in the world. The agricultural sector employs 35 percent of the country’s workforce, resulting in an excellent farming ecosystem. Thailand is the world’s leading exporter of cassava, sugar, rice, and palm oil, with a diverse crop portfolio. Agricultural textile products, such as soil moisture retention and agricultural non woven bags, have a high growth potential and are expected to increase farming productivity in the long run.

2. Nanotechnology in Textiles

1. Water-repellent Fabrics

A water-repellent fabric was one of the first products created using nanotechnology, and the market for this product is expected to exceed USD 2 billion by 2024. This technology improves the customer experience while also bringing huge returns and growth to manufacturers.

2. Antibacterial Textiles

Consumers are becoming more knowledgeable about hygiene as a result of rising health and wellness trends and Covid 19 pandemic. Antibacterial textiles, a pioneer in the textile industry, were developed to serve a variety of industries throughout the region. Several functional textile manufacturers are shifting their focus to antibacterial products such as sportswear, bandages, and medical uniforms. Perma Corporation is Asia’s leading producer of Nano Zinc Technology, the first permanent antibacterial textile.

Why Thailand to start clothing business?

1. Completed value chain

Thailand has approximately 4,700 textile manufacturers with a complete value chain, ranging from fibers, yarns, dyeing, and clothing. For more than 50 years, the textile industry has grown significantly, passing on the knowledge, expertise, and competencies of previous generations of manufacturers. Using cutting-edge technologies, Thailand has become the leading producer and exporter of a variety of textile products that meet global standards.

A number of manufacturers are implementing the smart factory concept to boost their competitiveness and productivity by utilizing computerized systems to increase efficiencies in their manufacturing processes. In addition to strict environmental regulations and standards, Thai manufacturers are embracing green production by promoting recycled raw materials and developing more advanced solid waste management plans.

2. Highly-skilled workforce

The Thai workforce is well-known throughout the world for its exceptional craftsmanship. The Thai government is working hard to ensure a strong labor force for the textile industry in order to boost its competitiveness. The country is well-equipped with highly qualified researchers and experts covering all aspects of textile production. This vital industry currently employs approximately 500,000 people.

3. Strategic location with excellent logistics networks

Thailand, located in the best location in Southeast Asia, is well-connected to ASEAN and other Asia-Pacific countries. Southeast Asia’s more than 640 million consumers present numerous opportunities for the textile industry. Thailand can connect with many destination countries thanks to world-class infrastructure such as Suvarnabhumi International Airport, Laem Chabang deep sea port, and other trade routes. Thailand is more than prepared to better serve logistics needs, thanks to FTAs with ASEAN countries.

Are you eligible to register an innovative clothing company under BOI scheme?

Ask your detailed question and receive legal advice in minutes from a lawyer that specializes in corporate law

4. Clothing and textile BOI incentives

The BOI recognizes the importance and value of the textile industry and provides a variety of tax and non-tax incentives for projects that contribute to national development goals.

1. Non-Tax Incentives

These activities are also eligible for the following non-tax benefits:

| ➤ Permit to bring in expatriates |

| ➤ Permit to own land |

| ➤ Permit to take or remit foreign currency abroad |