Ready to use legal template

Work on without any hassle

Certified Thai-English translation

Ready to use legal template

Work on without any hassle

Translated in Thai-English

Home › Accounting services › General receipt

Learn more about General Receipt

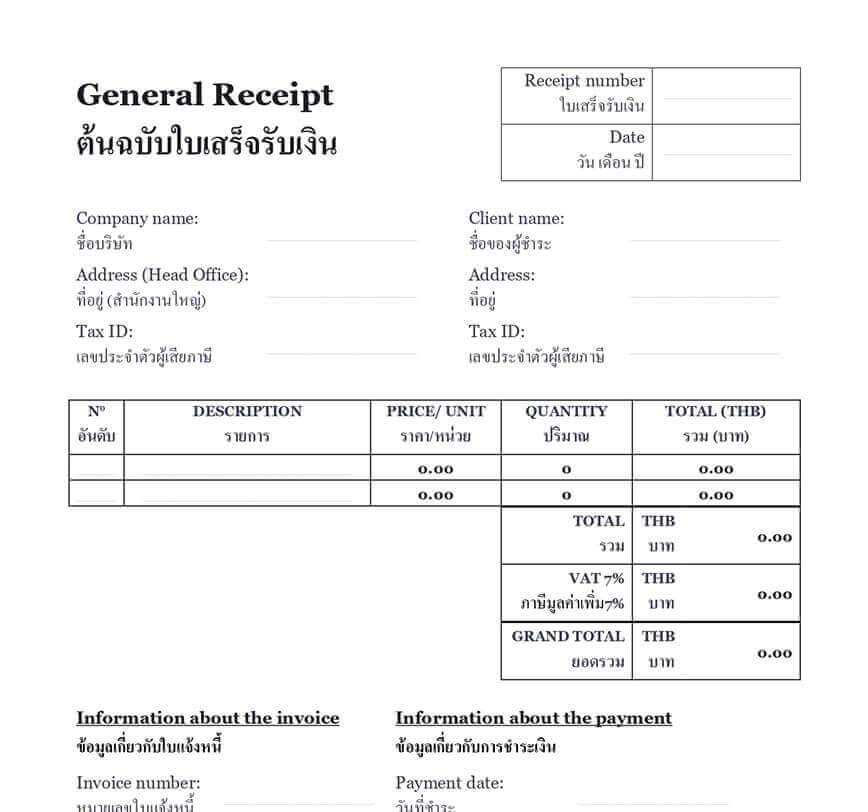

A general receipt, or simply “receipt”, is a document that serves as an acknowledgement of payment for a product or service. It is issued by the seller, who will generate an invoice, to the buyer who receives the good or service. When invoices are issued, when the customer pays, it is common for a payment receipt to be issued by the lender, which acknowledges receipt of payment. With a general receipt, the customer knows that the creditor has received the amount due. In other words, a general receipt is a proof of payment for both parties: the issuer and the recipient of the invoice. With Themis Partner, get a general receipt template in accordance with Thai accounting standards, translated into English and Thai. Also, you can benefit from the assistance of our accountants to help you manage your accounting.

Table of contents

What is a general receipt?

A general receipt is a document by which one acknowledges having received something. It is usually an invoice or a copy of an invoice given by the seller to the buyer and showing the words “delivered” or “paid”.

General receipts are an integral part of the daily life of any business, freelancer or individual. While the absence of an invoice or receipt may not seem like a big deal, these documents are the foundation of accounting. One of the basic principles of accounting is that there is no accounting without a receipt. The function of a receipt is to document business expenses and record fluctuations in materials. The activities of a business are accredited, made transparent and understandable through these receipts. This is why the general receipt is one of the most important documents for a company.

Can a general receipt be issued in electronic format?

A business is only allowed to issue electronic invoices and receipts if it is approved by the Director General of the Department of Revenue. It may then send electronic tax bills to its customers via email. Electronic tax bills must include a message indicating that they are issued electronically and that the information has already been provided to the Revenue Department, as well as a digital signature. The customer will immediately understand that they do not need to request the original tax invoices, as this type of electronic tax invoice can be used for VAT calculations.

What should appear on your payment receipt?

In order to issue a general receipt for your company, certain criteria are essential. The following data must not be missing from your general receipt:

| ➤ The title "receipt" |

| ➤ The reference number |

| ➤ The net amount |

| ➤ The total amount and the amount of the 7% VAT if applicable |

| ➤ The gross amount |

| ➤ Name and address of the issuing entity |

| ➤ Name of the recipient |

| ➤ Quantity and description of the products sold or the service provided |

| ➤ Place and date |

| ➤ Signature of the Director of the company and stamp of the company |