Home › Accounting services › Payroll

Learn more about Thailand Payroll Service

Employees are paid a flat rate, hourly or salary basis for their wages. However, prior to the payment of wages, the employer must calculate the net salary of its employees and deduct social security and withholding tax. In Thailand, employers are required to pay social security, national and sometimes local taxes for each employee. All these transactions must be recorded for audit and tax purposes for all accounting to be valid. The payslip is a mandatory document sent to an employee by his employer on a monthly basis or according to the periodicity of the pay. It is a summary of the various information relating to the work and remuneration of the employee. This document must be delivered to the employee under penalty of legal proceedings.

Table of contents

Why get a payroll service?

A payroll management company will allow you, for a fee, to manage all of these functions independently, freeing up time for the business owner for more important matters. Once the account is created, the employer simply provides the service with a list of all employees, hours worked and variances. This data is then processed and funds are transferred from the employer’s bank to the payroll department’s account. Employees are paid either by standard cheque or by direct deposit. The employer then receives payroll and tax reports.

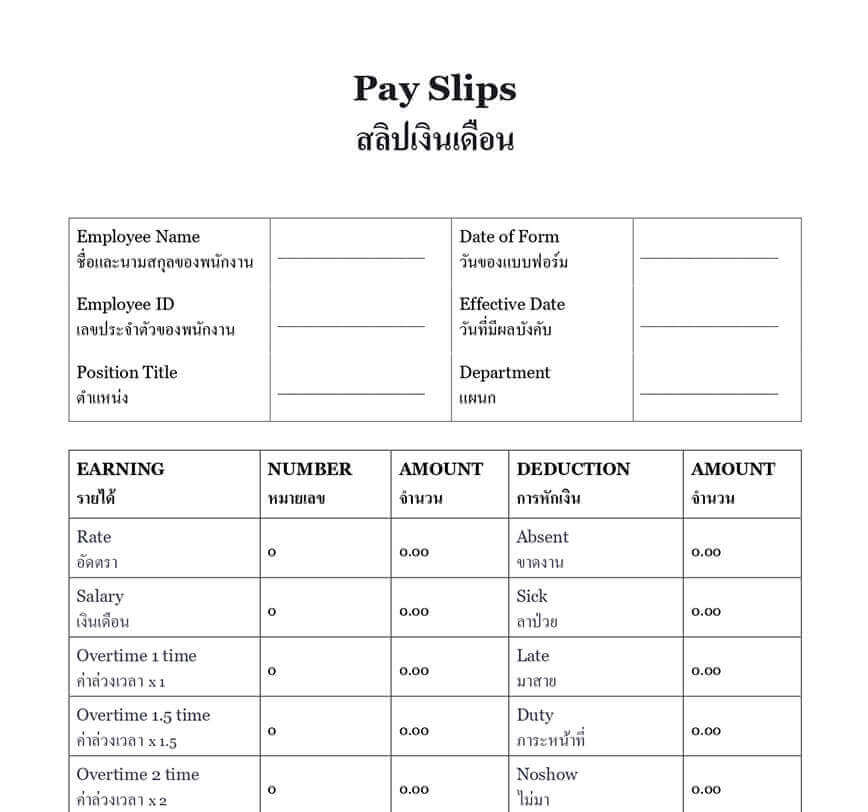

How to make a pay slip in Thailand?

In order to create a salary slip, the information must appear in the salary slip. Here is some information to assist you in creating your pay slip:

- Employer information: Company name, tax ID and address must appear on the pay slip.

- Employee Information: The employee's name and position must appear.

- Social security deducted and paid by the employer and the employee: it is not mandatory to show the elements related to the payment of social security.

- The withholding tax: The payment of the withholding tax by the employer can appear on the salary slip. In any case, it is important to remember that the employer has the obligation to transmit to his employees the withholding tax certificate showing all the withholding tax deducted from the employee's salary.

- The hours worked: it is useful to show the time worked by each employee on his pay slip.

- Salary: It is advisable to mention the monthly salary, the advance payments, the commissions, the bonuses and any other payment related to the salaries.

Of course, additional information can be added to the payslip, but we recommend that you use the payslip template we provide to ensure that you meet all the criteria of the payslip in Thailand

Is the payslip compulsory?

As for the written employment contract, the payslip is not mandatory in Thailand. However, it is strongly recommended to provide pay slips to your employees.

Which services for the management of the employees' payroll?

Payroll is more than just writing checks or setting up direct deposit payments. Payroll companies take on a wide variety of tasks, including:

- Payroll management and processing

- Payroll records

- Bank records to disburse funds to individual employee accounts individual

- Disbursements to tax, social security and provident fund provident fund

- Reports and declarations of the Social Security Fund

- Payroll reports and journal entries

- Preparation of personal income tax returns

- Social Security Fund registration, outgoing and incoming

- Worker's Compensation Fund

- Certificates and declarations of withholding tax

- Filing of all tax and social security declarations

- Administration of your company's provident fund

What information in a monthly employee payroll report?

Monthly payroll reports are useful in order to have full visibility and control over a company’s employee payroll.

The monthly report typically includes the following:

| ➤ Base Salary |

| ➤ Additional Income |

| ➤ Deductions |

| ➤ Withholding tax paid |

| ➤ Contribution to pension funds |

| ➤ Net salary payable |

| ➤ Details of staff who have resigned or terminated |

| ➤ Variance report showing the current month and the previous month |

| ➤ Confidential personalized pay slips |