Ready to use legal template

Drafted by experienced lawyers

Certified Thai-English translation

Ready to use legal template

Drafted by lawyers

Translated in Thai-English

Home › Business contracts › Shareholders agreement

Learn more about Shareholders Agreement

The purpose of a shareholders agreement for a Thai company is to organize the relations and define the rules of the game with your shareholder. The shareholders contract can be used to allow its signatories to control the exit of each shareholder concerned by the agreement, by providing for example a pre-emption clause, which gives its beneficiaries the right to acquire in priority the shares of a shareholder who wishes to sell, or an approval clause, which provides for a mandatory prior authorization of the shareholders before any transfer of shares. With Themis Partner, you can download your shareholders agreement in Thai and English in word format, including all the clauses allowing you to protect yourself as a shareholder of a Thai company.

Table of contents

-

What is a shareholders agreement?

-

How to draft a shareholders' agreement?

-

Why sign a shareholders agreement?

-

What are the characteristics of a shareholder contract?

-

What are the essential clauses of a shareholders agreement?

-

How to split in case of disagreement between shareholders?

-

Can a stockholders agreement be terminated?

-

What are the mistakes to avoid when drafting these clauses?

-

Is a shareholders' agreement mandatory?

What is a shareholders agreement?

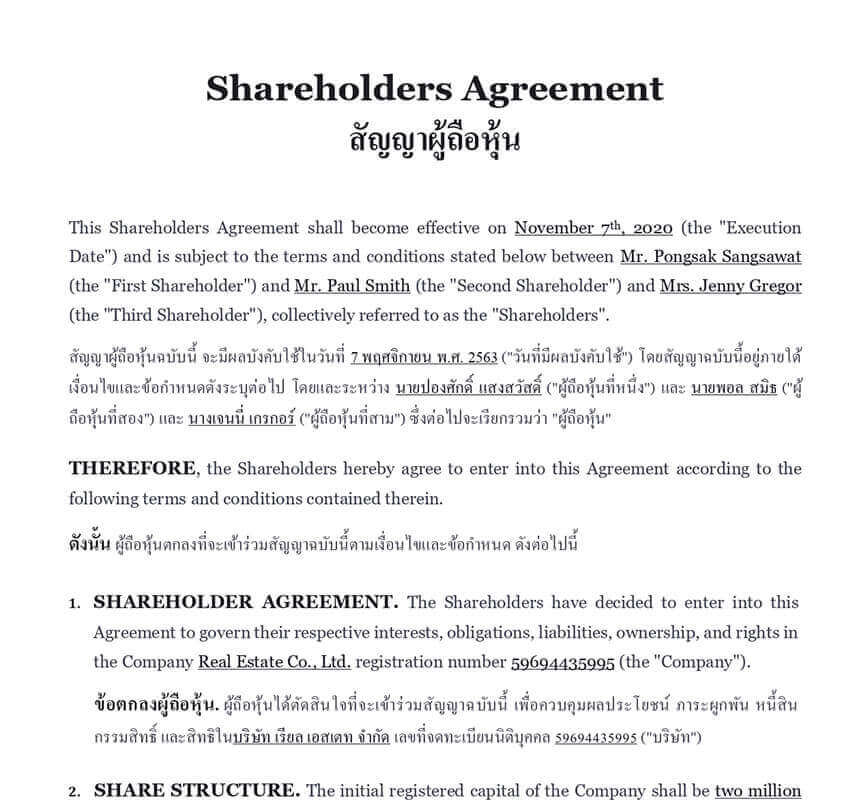

The shareholders’ agreement is a contract that is concluded between all the shareholders of a Thai company. This contract will define and frame a set of conditions for the management of the company. The shareholders’ agreement, also often referred to as the stockholders agreement, is added to the company’s articles of association and includes clauses such as buy or sell clauses or voting clauses that are not stipulated in the association’s writings.

How to draft a shareholders' agreement?

The shareholder agreement must be drawn up in writing by means of a private document. The shareholders who sign the agreement can draft it themselves by downloading a professional template, or they can hire a business lawyer. The stockholders agreement can be signed at any time. It is usually put in place at the time of the creation or acquisition of the company. Be aware that if you wish to have a memorandum of understanding drafted by a lawyer, it is also essential that the other shareholders have another lawyer to ensure that the agreement protects their interests.

What are the characteristics of a shareholders contract?

The shareholders’ agreement is an extra-statutory legal act aimed at organizing the circulation of shares and the functioning of the company. It can be signed by all the shareholders of a company or by some of them only. In the latter case, the other shareholders are not aware of it. The shareholders’ contract is a secret document in that it is not known to third parties. Unlike the articles of association, it is not filed with the Thai Business Development Department.

Details on the duration of the shareholders' agreement

The signatories must agree on a term for the agreement, which may be fixed in time by setting a specific date or event, or indefinite, in which case the agreement may be terminated unilaterally. Sometimes the shareholders provide that the agreement lasts as long as the signatories or their successors remain shareholders. In this case, the term of the agreement is deemed to be indefinite because the end of this condition may never occur.

Details on termination of the shareholders' agreement

The stockholders’ agreement may be terminated on the date agreed upon by the signatories, upon the occurrence of the event foreseen by the signatories, in case of unilateral termination by one of the signatories when the term is indefinite, or by other reasons that must be specified in the agreement (failure to comply with a clause, exclusion of a partner…).

What are the essential clauses of a shareholders agreement?

Generally speaking, the main clauses that are usually found in a shareholders’ agreement adapted to a Thai company are the following:

The pre-emption clause: if one of the signatories of the agreement wishes to sell its shares, it must first propose them to the other signatories. This clause allows the other shareholders to control the company in case of departure of a shareholder.

The approval clause: the agreement of the signatories of the agreement must be obtained before a signatory can sell his shares. This clause is essential because it prevents a third party shareholder from becoming a shareholder of the company without the agreement of the other shareholders.

Limitation of shareholder ownership: This clause is intended to stipulate that no signatory of the agreement may hold more than a certain number of shares in the company, thus limiting the control of a company by a majority shareholder.

The right to follow: if one of the signatories receives an acquisition proposal, it must ask the potential buyer to extend its bid to the other signatories of the agreement. This way, everyone leaves the company at the same time. This clause is useful, especially if the presence of one of the shareholders is vital for the management and continuity of the company.

The non-transferability clause: the signatories undertake not to transfer their shares during a certain period which must be determined. This clause allows to protect the company from any action of the shareholders during a given period.

Of course, the drafting of your memorandum of understanding must be done taking into account the specificities of your company and the shareholders. In all cases, we recommend that you include clauses aimed at protecting the company’s continuity in order to avoid any difficulties when selling to the shareholders.

How to split in case of disagreement between shareholders?

It is best to provide for future and hypothetical separation arrangements with your partner through the shareholders’ agreement. The shareholders’ agreement is binding as a contract. Its non-performance may give rise to a claim for damages or trigger expressly provided punitive mechanisms, such as a penalty clause. The shareholders contract is an opportunity to provide for several legal mechanisms intended to foresee in advance how the departure of a partner will take place:

A negotiation phase: if you disagree and the transfer is between Partners, it is essential to agree on the share transfer price and the conditions of the transferor’s departure from the company.

The drafting of the transfer of shares: In the case of a share transfer, the deed of sale must be signed by the transferring and transferee shareholders and registered with the business development department.

Can a stockholders agreement be terminated?

The shareholders may agree on a limited duration for the agreement. Indeed, as with any contract, the duration of the agreement may be fixed in time or conditioned by the occurrence of an event. Conversely, the agreement may also be of indefinite duration. In this case, any signatory has the right to unilaterally terminate it at any time. Similarly, because of the flexibility of the agreement, the signatory shareholders can provide that the breach of a provision will result in the termination of the agreement.

Under Thai law, it should be noted that a decision that is not in accordance with the agreement but is in accordance with the association’s articles of association cannot be overturned. The agreement has less legal force than the association’s articles of association. However, such a breach may lead to compensation for the damage suffered, both to the parties and to any third party who has suffered damage, provided that the conditions for personal liability are met. Although the shareholders’ agreement is, therefore, less legally binding than the articles of association with respect to the obligations of the shareholders, it remains an effective tool for the rational and careful management of the company.

What are the mistakes to avoid when drafting these clauses?

It is essential to keep in mind that the stockholders’ agreement is an appendix to the association’s bylaws. It cannot replace or contradict the bylaws; it merely supplements them. The clauses in the shareholders’ contract are general clauses that could be included directly in the association’s bylaws, so the agreement must reassure the various shareholders. If it is too restrictive, too rigid, or too complex, it will discourage some stakeholders from taking part in the project.

Here are the most common mistakes to avoid when drafting a shareholders’ agreement:

| ➤ Implementing unanimity for too many decisions: this could block the functioning of the company |

| ➤ Do not foresee in advance the conditions of resolution of specific conflicts or who will be the mediator or arbitrator in case of disputes |

| ➤ Do not mention the distribution of dividends |

| ➤ Not mentioning financial sanctions in case of default or misconduct of a signatory shareholder |

| ➤ Do not mention the remuneration and benefits of directors. This clause allows to avoid abuses |

| ➤ Do not provide for the distribution of the shares of a deceased shareholder |